A new research report from the IoT analyst firm Berg Insight reveals that the penetration of smart electricity meters in Latin America* reached 6.2 percent in 2022.

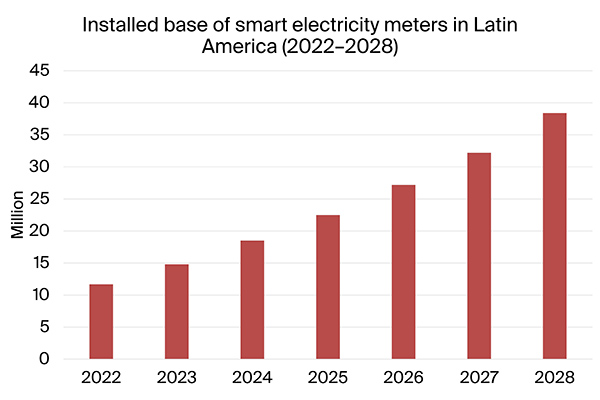

The installed base of smart electricity meters is forecasted to grow at an impressive compound annual growth rate of 21.7 percent during 2022–2028 to reach a total of 38.4 million units at the end of the forecast period, up from around 11.7 million units in 2022.

The smart metering market in Latin America is becoming increasingly interesting for a variety of smart meter players, as a number of utilities across the region are increasing their investments in AMI infrastructure. Over the next six years, the penetration rate of smart meters in Latin America’s by far largest market Brazil will increase from a mere 5.7 percent in 2022 to 21.5 percent in 2028. Brazil and Mexico will account for close to 80 percent of the total smart meter shipments during the forecast period.

Mattias Carlsson, IoT Analyst at Berg Insight, said:

“The number of meter installations in Latin America will continue to grow in the coming years and will be driven by the expansion of ongoing smart metering projects and new major projects. Besides the major markets Brazil and Mexico, countries like Colombia and Peru will grow their share of annual shipment volumes from around 4 percent in 2022 to over 16 percent by 2028. Colombia for example is forecasted to increase annual shipment volumes tenfold, whereas Peru will increase annual shipment volumes sixteenfold during the forecast period.”

According to the newly released study, yearly shipments of smart electricity meters in Latin America will grow from around 1.9 million units in 2022 to over 6.1 million in 2028. This makes Latin America one of the fastest growing smart metering markets worldwide.

The use cases in Latin America include remote meter reading, fault detection, distribution automation and measuring power quality.

Mr. Carlsson concluded:

“As Latin America is poised for significant growth in the coming years, the race has begun between the top meter vendors to gain market share in the region. To date, Chinese smart meter vendors have achieved significant success in Latin America. One key contributing factor is their ability to offer competitive pricing, a crucial aspect for the price-sensitive utilities operating in the region.”