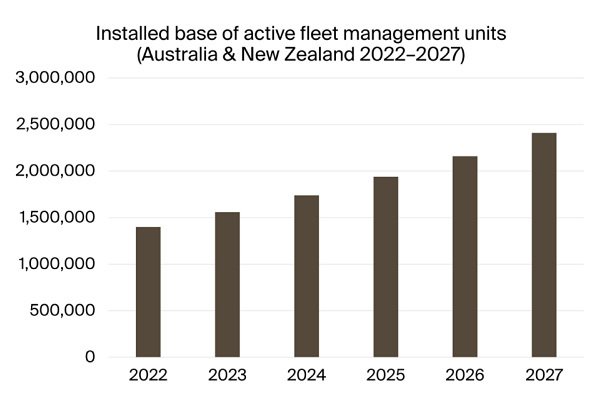

The number of active fleet management systems deployed in commercial vehicle fleets in Australia and New Zealand was around 1.4 million units in Q4-2022 according to a new research report from the leading IoT analyst firm Berg Insight.

Growing at a compound annual growth rate (CAGR) of 11.5 percent, this number is expected to reach more than 2.4 million units by 2027. A large number of vendors are active on the fleet management market in Australia and New Zealand. The top-15 players in the region together account for over 60 percent of the active units on the market, and more than a third is represented by the top-5 alone.

A wide variety of players serve the fleet telematics market in Australia and New Zealand, ranging from small local vendors to leading international solution providers.

“Berg Insight ranks Teletrac Navman, EROAD and MTData as the largest providers of fleet management solutions in Australia and New Zealand”, said Rickard Andersson, Principal Analyst, Berg Insight.

US-based Teletrac Navman (part of Vontier) was the first to reach 100,000 units in the region and this milestone has now also been achieved by New Zealand-based EROAD (including Coretex acquired in 2021) and Australia-based MTData (owned by Telstra).

“The remaining top-5 solution providers in the region are US-based Verizon Connect and Netstar Australia”, continued Mr. Andersson.

He adds that US-based Rand McNally which acquired Fleetsu in Australia in 2022 is now also a significant player. Other notable vendors with comparably sizeable subscriber bases in the region include local solution providers such as Australia-based IntelliTrac and Linxio and New Zealand-based Smartrak (Constellation Software), as well as international players including Canada-based Geotab and South Africa-based MiX Telematics. Fleet Complete, also based in Canada, entered the region through the acquisition of Geotab’s reseller Securatrak.

“Additional top-15 players in the region are Digital Matter and Procon Telematics as well as Bridgestone Mobility Solutions’ Webfleet and Fleetdynamics by Fleetcare”, said Mr. Andersson.

Solution vendors just outside of Berg Insight’s top list moreover include Directed Technologies (Directed Electronics Australia), Sensium, Inseego, TrackIt and Microlise. Directed notably works with a large number of commercial vehicle OEMs on the local market.

“OEMs which have launched fleet telematics solutions in the region independently or through partnerships include UD Trucks, Toyota, Hino, Mitsubishi, PACCAR, Volvo Group, Daimler Truck, Fuso, Scania, MAN and Iveco”, concluded Mr. Andersson.