Berg Insight, the world’s leading IoT market research provider, today released new findings about the market for Intelligent Transport Systems (ITS).

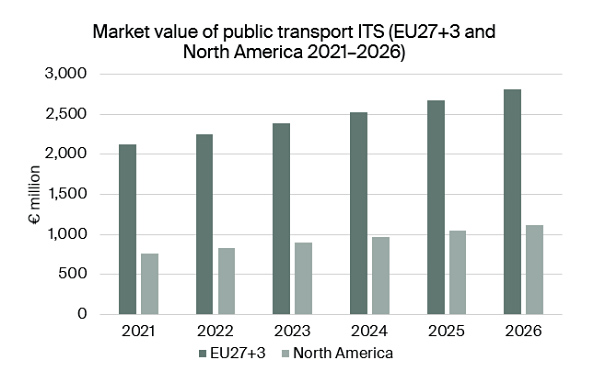

The estimated market value for ITS deployed in public transport operations in Europe was € 2.12 billion in 2021. Growing at a compound annual growth rate (CAGR) of 5.8 percent, this number is expected to reach € 2.81 billion by 2026. The North American market for public transport ITS is similarly forecasted to grow at a CAGR of 8.1 percent from € 0.76 billion in 2021 to reach € 1.12 billion in 2026.

Berg Insight is of the opinion that the market for ITS in public transport is in a growth phase which will continue throughout the forecast period. A growing awareness among public transport providers of the various benefits of ITS along with increasing demands from travellers for convenience and accessible real-time information contribute to a positive market situation. In addition, governments in both Europe and North America see public transport as a prioritised area for investment. For instance, the US Bipartisan Infrastructure Law, passed in November 2021, has allocated up to US$ 108 billion for investments in the modernisation of public transport between 2022 and 2026.

A group of international aftermarket solution providers have emerged as leaders on the market for public transport ITS. Major providers across Europe and North America include Canada-based Trapeze Group and Germany-based INIT with significant installed bases in both regions. Clever Devices and Conduent hold leading positions on the North American public transport ITS market. The former has expanded into Europe with an acquisition and the latter is an international provider of fare collection systems. Additional companies with notable market shares in North America include Cubic Transportation Systems and Avail Technologies.

Examples of major vendors on national markets in Europe include EQUANS and RATP Smart Systems, which hold leading positions in France, and IVU, which is an important player primarily in the German-speaking part of Europe. Vix Technology, Flowbird and Ticketer are moreover major providers on the UK market. Other significant players include the Spanish groups GMV, Indra and Grupo ETRA; French Thales; Atron in Germany; Scandinavian FARA and Consat Telematics; and Austria-based Swarco and Kontron Transportation. Volvo Group and Daimler are moreover notable players from the vehicle OEM segment, while companies such as Scania, Iveco, Gillig and New Flyer also offer some conventional OEM telematics features for their buses.

Caspar Jansson, IoT Analyst at Berg Insight, said:

“The penetration rate of on-board computers featuring GPS location functionality and wireless communications has now reached very high levels, especially in urban areas in North America and Western Europe”

The Mediterranean countries and Eastern Europe are working on catching up. “This development was reinforced by the COVID-19 pandemic”, continued Mr. Jansson. He adds that because of the pandemic, an accelerated adoption of modern ITS solutions can be seen as a way to comply with the restrictions on human contact and to reduce the complexity of using public transport. “Many operators have for example installed new contactless ticketing solutions and passenger counting systems over the last two years, to make the lives of commuters easier”, concluded Mr. Jansson.